Support and Resistance Forex Trading

Support and Resistance Forex Trading

Event areas are key levels in the market where a major price action event occurred. This can be a big reversal or clear price action signal either of which led to a strong directional move. Note, in the example image below, we had a large trading range as price was clearly oscillating between resistance and support.

About Nial Fuller Nial Fuller is a Professional Trader & Author who is considered ‘The Authority’ on Price Action Trading. He has a monthly readership of 250,000+ traders and has taught 20,000+ students since 2008. In 2016, Nial won the Million Dollar Trader Competition.

As a result, the global markets will frequently create levels of support and resistance that are psychologically significant. In contrast, other market participants may sit back and wait for the currency to lose some value, especially if it shot up in price upon surpassing resistance. In this case, the investors who hold back could be a new source of support. If a currency has difficulty falling below a certain price, it has reached a support level. Generally, this happens because a currency’s drop in value has resulted in there being more buyers than sellers.

One is that these prices have been significant in the past and traders know they are likely to be again. Market participants often gauge future expectations based on what has happened in the past; if a support level worked in the past, the trader may assume that it will provide solid support again. Fear and greed, for example, are seen in the market participants’ behavior outlined above.

It’s important to note that for a trend line to be an important support or resistance line, the price has to respect the trend line at least three times. You can see from the above charts resistance does not always hold and break above resistance signals that the bulls have won out over the bears. Thus, a second strategy that becomes profitable is to put in buy stops at a breakout, perhaps x pips beyond the resistance level in order to confirm it as a valid break.

I am in a long position after the red bullish trend line. The thicker parts of the trend show where the price finds support. While I am in my long position, I see the price getting close to an old resistance, which has already been tested few times and has sustained the price of the Yen.

Absolutely true! Support and resistance are not a single line.

These will help you analyze the current trends, ranges, and chart patterns. These minor levels lose their relevance quite quickly as new minor support and resistance areas form. Keep drawing the new support and resistance areas, and delete support and resistance lines that are no longer relevant because the price has broken through them. In a perfect forex trading world, we could just jump in and out whenever price hits those major support and resistance levels and earn loads of money. Many retail forex traders make the error of setting their orders directly on support and resistance levels and then just waiting for their trade to materialize.

By clicking and dragging these shapes/areas on the right side of the chart, we have found classical support and resistance levels for the period ahead of us. A trader doesn’t know how long the market will take to clear these levels, and, to be honest, it should not matter in the least. Price can, however, fall right through the support level. As price continues to drop, traders will quickly realize that the support level is not holding.

The main difference between dynamic and semi-dynamic levels is the fact that semi-dynamic levels only change at a fixed rate per candle, whereas dynamic levels change at a non-fixed (flexible) rate. Depending on the method used, the S&R levels can either be automated, or drawn manually on the chart. The Fibonacci retracement tool needs to be drawn manually on the chart by the trader, whereas a moving average is calculated automatically by the MT4 or MT5 platform once it has been added to the chart. The horizontal level marked with point (1) acted as a support for the price at point (2).

- False breakouts of support and resistance, even if you don’t trade them, tell a story that the zone is still of interest and acting as a barrier to price.

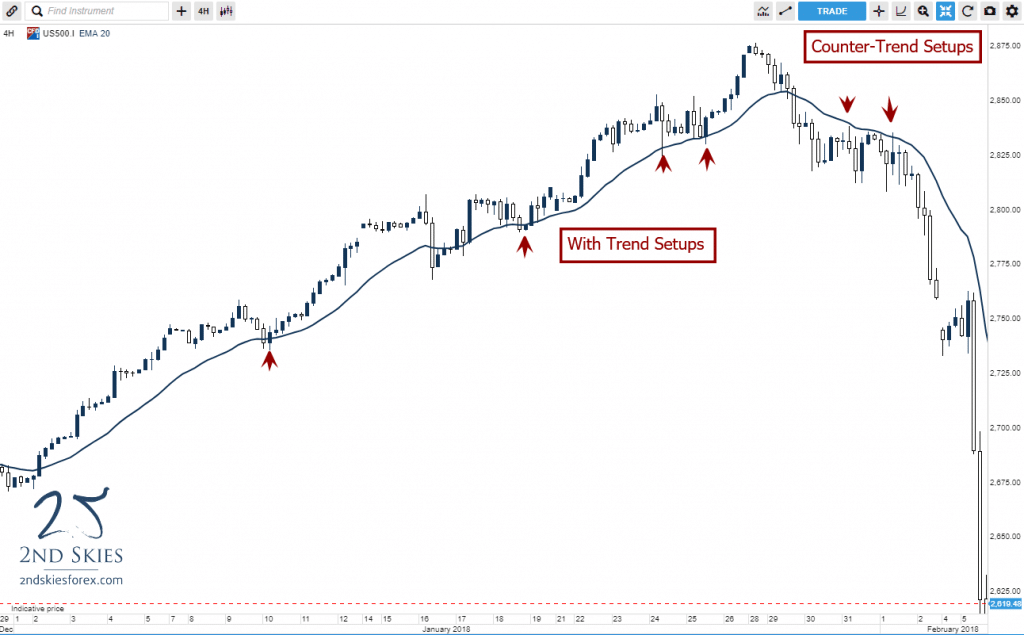

- Two key things which really help this are using the two touch rule, along with trading more with trend than counter trend.

- Any support and resistance area is indeed an “area”, and not just a single/simple level.

- The scenarios of the price testing dynamic S&R levels drawn by EMAs are shown in red circles.

- For example, if a currency breaks past resistance, such a development can draw the interest of many investors, driving its price higher.

Support and Resistance Trading Strategy — The Advanced Guide

You should preferably use the S&R level on the same high time or one time frame lower. Very max, time frames lower. Keep in mind, in all of these with trend pullbacks, the market pulled back towards the levle that it hat the strongest rejection from at A, B and C. The strong rejections at those levels are counter-trend players, trying to stop the trend. But when the bears tried to get past the last major resistance, now turned support (forming a role reversal level), the bulls used this as an opportunity to get long.

That new support level was retested on March 31 2011, with a big bounce upwards, providing confirmation that that level was indeed strong support. Thus, it was little surprise that when price again fell to that 0.9130 support again on April 06 2011, it again bounced back.

To increase the likelihood of profitable trades, first mark key support and resistance levels on higher timeframes, such as the 4-hour and daily ones. After this, zoom-in to the 15-minutes charts to trade on shorter-term support and resistance levels. Not all support and resistance levels work the same or produce trade setups with equal probability of success. Here’re some pro tips on increasing the likelihood that a trade based on key support and resistance levels becomes a winner. If you’re serious about your career as a trader, you need to learn how to trade support and resistance levels early in your trading career.

DeltaStock — Global Forex and CFD Broker

nothing is 100% certain, price can break the levels and not obey them. Once a support level is identified, draw a horizontal support line and wait for price to fall back to that support line. Look for a series of high points where price does not rise above this any further, this is your resistance level. Look for a series of low points where price does not fall below this any further, this is your support level.

Because likely, in a trend, there will be a support or resistance level that is already being challenged, which would confirm there are buyers or sellers at the level trying to defend it, while the other side is attacking it. Once it breaks, the with trend traders often look for a pullback towards this level to get back in with trend. A great example of this is in the chart below. We have a specific article on this very topic so go ahead and read that here if you do not know what support or resistance is. Support is the level where price finds it difficult to fall below until eventually it fails to do so and bounces back up.