Types of Trading Strategies

Types of Trading Strategies

Once you’ve reached that goal you can exit the trade and enjoy the profit. After an asset or security trades beyond the specified price barrier, volatility usually increases and prices will often trend in the direction of the breakout.

The mentality associated with an active trading strategy differs from the long-term, buy-and-hold strategy found among passive or indexed investors. Active traders believe that short-term movements and capturing the market trend are where the profits are made. A Day Trade consists of two off-setting transactions which occurred in the same security on the same day. The order of these transactions must be opening followed by closing.

Here is another strategy called best Gann Fan Trading Strategy. Day traders pay particularly close attention to fundamental and technical analysis, using technical indicators such as MACD (Moving Average Convergence Divergence), the Relative Strength Index and the Stochastic Oscillator, to help identify trends and market conditions. For those that are not comfortable with the intensity of scalp trading, but still don’t wish to hold positions overnight, day trading may suit. They also tend to trade only the busiest times of the trading day, during the overlap of trading sessions when there is more trading volume, and often volatility. Scalpers look for the tightest spreads possible, simply because they enter the market so frequently, so paying a wider spread will eat into potential profits.

However, when you get a basic understanding of the types and kinds of trading opportunities that will be available to you, then you can move onto putting together your own unique trading strategies. You will need a very well thought out money management system that will both help you reduce your level of risk whilst maximizing your profits.

We are going to have many trading strategy examples that you can use as a template to help build. You’ll complete a basket of useful strategies that you will be able to reference in the future.

This guide is dedicated to that very subject and we will pass onto you several ways you can adopt one or more easy to understand and follow trading strategies. Probably one of our first trading guides you should make full use of is our guide which is going to show you how you can make money trading Forex Options either online or via a mobile device. So feel free to take a look over it if you are new to the world of Forex options trading.

Entry positions are highlighted in blue with stop levels placed at the previous price break. Take profit levels will equate to the stop distance in the direction of the trend. Key levels on longer time frame charts (weekly/monthly) hold valuable information for position traders due to the comprehensive view of the market. Entry and exit points can be judged using technical analysis as per the other strategies.

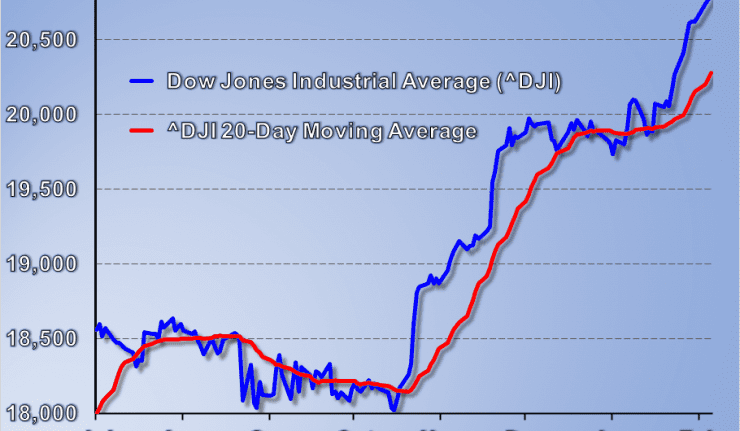

They can be grouped into several types based on their internal logic or usage, such as volume, volatility, oscillators and moving averages. These indicators and strategies are coded in the Pine programming language which allows users to create them from scratch. Sometimes a stock that wasn’t gapping up and already on my radar for a Gap and Go!

Trading

72% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Make sure that you’re disciplined enough in preserving your trading account so that you can live to trade another day. This means that before any trade is entered, a detailed trading plan should be created and adhered to.

Question: What Are the Best Forex Trading Strategies?

- Swing traders (as well as some day traders) tend to use trading strategies such as trend trading, counter-trend trading, momentum and breakout trading.

- Market analysts and traders are constantly innovating and improving upon strategies to devise new analytical methods for understanding currency market movements.

- However, it’s important to note that tight reins are needed on the risk management side.

This is usually considered a medium-term strategy, best suited to position traders or swing traders, as each position will remain open for as long as the trend continues. Intraday trading takes time, focus and dedication to a trading plan. It involves executing a large number of trades for relatively small profits compared to position trading – this makes it vital that day traders do not fall prey to the temptation of letting a losing trade run, as it can eat into their profits. To mitigate the risk of losses, day traders often use stops and limits. Attaching a stop-loss to a position will enable a trader to keep their risk at a known level, while limits will lock in any profits.

You need to constantly monitor the markets and be on the lookout for trade opportunities. It will also outline some regional differences to be aware of, as well as pointing you in the direction of some useful resources. Ultimately though, you’ll need to find a day trading strategy that suits your specific trading style and requirements. Day trading, position trading, swing trading, and scalping are four popular active trading methodologies.

Timing – The market will get volatile when it opens each day and while experienced day traders may be able to read the patterns and profit, you should bide your time. So hold back for the first 15 minutes, you’ve still got hours ahead. Money management – Before you start, sit down and decide how much you’re willing to risk. Bear in mind most successful traders won’t put more than 2% of their capital on the line per trade.

What is day trading? Day Trading is the simple act of buying stocks with the intention of selling them for a higher price (Short selling traders sell stocks with the intention of covering at a lower price to make a profit).

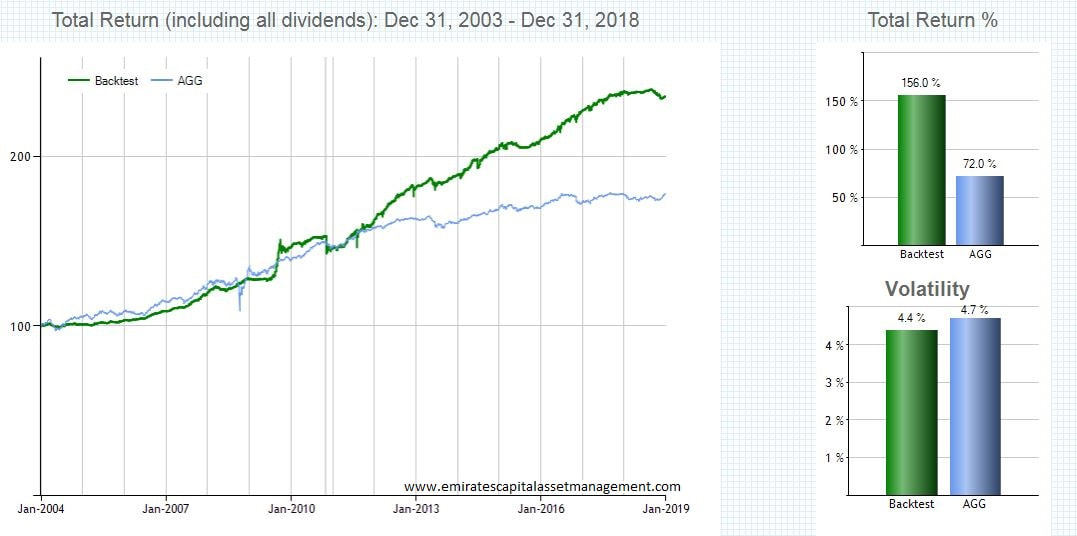

The easiest way to evaluate the performance of trading strategies in Python

It can also be essential to check the news for such events as the oil supply and demand release each week. We also have training for winning news trading strategy. The Forex Market has a high level of price movement which means that there can be fakeouts. This can move you out of your position.

It will also enable you to select the perfect position size. Position size is the number of shares taken on a single trade. Take the difference between your entry and stop-loss prices. For example, if your entry point is £12 and your stop-loss is £11.80, then your risk is £0.20 per share.